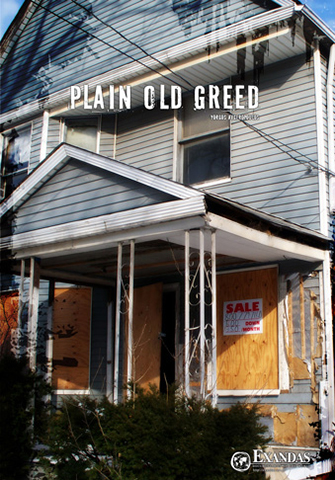

Plain Old Greed

Dir: Yorgos Avgeropoulos“Plain Old Greed”, Exandas new documentary film, is an “economic thriller” or, rather, a social horror movie which is timelier than ever. Through the saddening stories of those who lose their homes because of the savage bank raid emerges the famous “housing crisis” which torments the US economy and causes huge damage at a global level. However, what is more important is the unveiling of the logic of modern globalized economy and its “secret mechanisms”. In other words, the money market’s new way of making money… out of thin air!

Watch the Film Now!

Choose the language you prefer and stream the film in Full HD from any digital device. Enjoy your private screening!

Buy the DVD

€9,99

Public Screening

Are you interested in organizing a public screening of our film? Send us an email with your inquiry and we will be glad to assist you!

Educational / Library Use

Are you interested in enriching the library of your institution with our film? Contact us and let's create together an informed public!

- DURATION: 58min

- AVAILABLE IN THE FOLLOWING LANGUAGES: English | Greek

- AVAILABLE VERSIONS: English (58min) | Greek (58min)

- YEAR OF PRODUCTION: 2008

- Written & Directed by: Yorgos Avgeropoulos

- Director of Photography: Alexis Barzos

- Production Manager: Anastasia Skoubri

- Research Coordinator: Angelos Athanasopoulos

- Editing: Yiannis Biliris

- Original Music: Yiannis Paxevanis

- Graphics: Sakis Palpanas

PRODUCTION NOTES

The US economy is currently going through one of the biggest crises of its history. Banks are crumbling and economic giants bankrupting, taking the world’s markets down with them. Over a million US citizens in the whole country have already lost their homes. One household out of 538 is in the midst of a seizure process. In the following years, millions will find themselves on the streets.

In Cleveland, Ohio, the situation is dramatic. Entire areas have been deserted as if devastated by a typhoon. Thousands of houses lie empty as ghosts, destroyed by opportunists who tore apart everything (even the piping) as soon as the families living there were driven away. Sheriff Dave Row forces at least ten families out of their homes each day. “There have been many cases of evictions where I truly pitied the people…”, he says. “I’ve had eviction cases against other police officers… I’ve had to kick out firemen, even old people who had no idea of why they were being kicked out, victims of predatory loaning. And believe me… it’s hard! It feels bad, but I have to do my job!”

Having said this, Sheriff Row visits Karen, an average American who bought her house with her husband, Michael, in 1972. They recently received a 145,000 loan to refurbish. However, things went wrong. Michael lost his job and Karen fell ill and had to stop working. What has been their home for the past 36 years is now being seized by the bank. “Ok, alright… if the sheriff’s going to come here with his gun, I’ll be here, for sure. This is still my stuff, even if they say my house belongs to them! But they stole my house! It doesn’t belong to them!”, Karen says, crushed. “If they’re going to steal my house, they’ll have to pay for it… they’ll have to pay”. The crisis spread throughout the whole country, Nevada, California, Florida, and it wasn’t long before it reached the “world’s metropolis”, New York. Ron, who cleans up houses after murders or suicides, is busier than ever. “Suicides have gone up a lot”, he says. “We generally find letters which explain the reasons – usually economic – as well as tens of bills which haven’t been paid for months”.

Buyers lose their houses as they cannot pay off the housing loans they have received. The houses are taken away by banks who cannot, however, sell them as the market has been destroyed. They were the same ones that gave loans “with 0% deposit and 100% financing”, “without income checks and annoying supporting documentation”, bombing and enchanting the public with their publicity spots. And the public believed them. People with no income, even unemployed citizens, fell for the American dream: The beautiful house with the garden, intensely portrayed in Steinberg’s literary work and the “American family” films of the ’60s. Nowhere else has the owning of a house been linked to social rise and recognition as much as in the US. People bought their access to a world they knew from the beginning they couldn’t afford, but were told they could achieve.

These loans were called “liar loans” says, laughing, Jim Rokakis, County Treasurer of Cleveland and of Cretan descent. “73% had little or no income evidence. You’d ask someone ‘how much do you earn?’, and they’d say ‘oh, I make 100,000 dollars’, but they didn’t! However, if you don’t ask for a statement of account, if you don’t ask for tax returns, how do you know these people aren’t lying? Well, they were!”

Didn’t the banks know? Were they deceived? Of course not! They knew exactly what was happening. But why would banks lend money to people they already knew couldn’t pay them back? For one and only reason: to make more money! And that money wouldn’t come from confiscated houses but from the stock market! Yes, from Wall Street! In other words, when banks realized they could make a lot of money by lending to anyone, their game became “lend as much money as you can and don’t worry about getting it back”.

Observe this truly ingenious method the money market made up in order to increase its profit. A bank filled with millions of house mortgages from granted loans rids itself of the loans immediately. How? By creating an offshore company and selling the loans to it. The offshore company receives the loans and divides them into hundreds of investment packages, bonds bought through Wall Street by investors around the world. So, in our “globalized era”, the loan of an average US citizen can be in the hands of a Beijing investor. The housing loans structure collapsed when borrowers weren’t able to pay off their loans. The risks were much higher than the wizards of capitalism had estimated. Banks had sold air, intermediaries had sold air, investors had bought air, 8 trillion dollars were being handled that way.

The first to be devoured by the lawlessness of the uncontrolled market were its creators themselves. Banking giant Bear Sterns, with an eight decade-long history, collapsed in two days. All banks suffered billion dollar losses. And then came a global avalanche. Damages around the world are estimated at 1 trillion dollars, causing the rise of basic food prices in the whole world. Which in turn caused the impoverished in Haiti and the poor in Egypt, facing hunger, to clash with the police. The end of an empire? “Nothing lasts forever”, says Columbia University economist Graciela Chichilnisky. “It is an economic scandal which will leave deep scars in the social tissue and create more homeless people living on the streets”.

“If we could save all that we spend in Iraq we would have no problem”, says James Sanders, commune chairman of Far Rockaway, New York. “But you can’t have bullets and bandages at the same time… You can’t have bullets and bread at the same time… You must choose.”